The Pitch for Investors: 9 Fundamentals

o pitch para investidores

There are few challenges as exhilarating and terrifying as crafting a pitch. Especially when the objective is to raise capital from investors.

As with any business plan, a pitch must be well structured and prepared to answer all investor questions and, most importantly, convince them to invest in you and your project.

In a pitch, everything you do should be simple, clear and to the point. The 9 points we present below will help you understand the essential fundamentals of a pitch to investors.

1# The history of the entrepreneur and his connection to the business

Who you are and how you present yourself makes all the difference. You are the image and story of your business idea, your startup. Investors will be betting both on you and your business. After all, it will be you who will be at the head of the startup, so you must immediately show confidence and motivation throughout the pitch.

During the presentation to investors, don’t be afraid to talk about yourself and your connection to the business. This helps to understand your commitment and your background.

2# From problem to opportunity

What problem is your idea solving? What is the opportunity that no one is taking advantage of or that no one has been able to identify but you?

This is the starting point. This is what creates investor interest.

3# The solution that solves the problem

If the problem creates interest, it is the solution that convinces the investor to pay attention to it and consider investing in you.

Start right away with the main benefit of your solution. What sets it apart and what will make customers want it. Again, clearly, simply, and objectively. And speaking of objectivity, it is important to demonstrate how easy it will be to apply your solution in the market.

4# Dimension of the market where you will operate

The investors you are presenting your pitch to may not be from the same market or may not have in-depth knowledge of the niche market where your startup will operate.

It is important that you identify your startup’s market well, presenting data and information about it, based on research and numbers from credible sources.

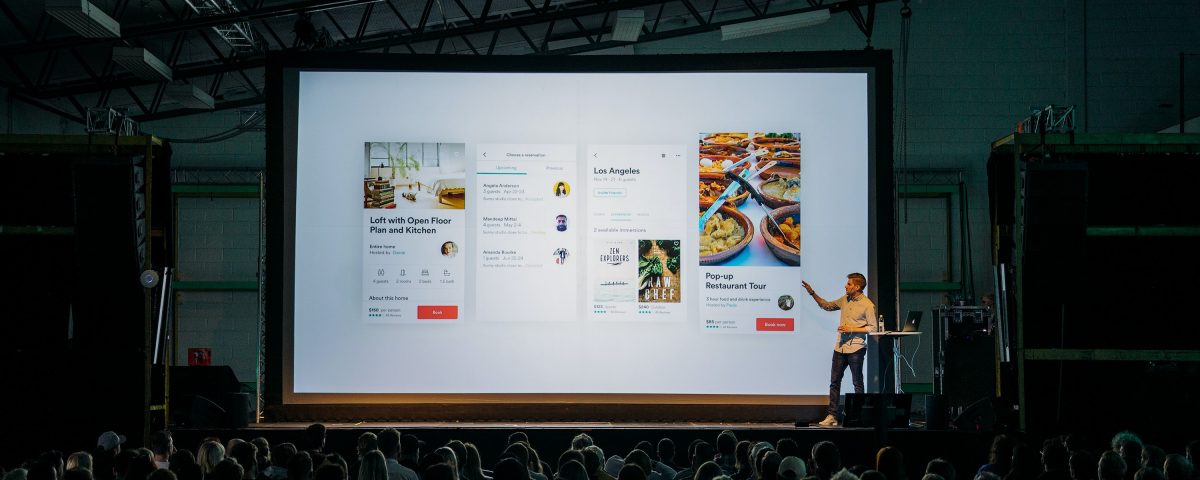

Practical tip: Present information through graphics, bullet points and eye-catching diagrams instead of a massive text. This way it will be easier for the investor to visualize the information and be attracted.

5# The business model

The business model clearly and objectively demonstrates how you will earn money from the project. It should answer the following questions: What are the sources of revenue? How will you acquire your customers? What are your margins?

Practical tip: Present a simple outline of your business model.

6# Competitors and competitive advantages

Know your competition well and introduce it to investors during your pitch.

A SWOT analysis can help you identify the advantages your startup has over the competition.

Practical tip: If some of your direct competitors have already raised capital from investors, put those values in the pitch. This information gives insight into how much the market is paying and can help in your favor.

7# Your team

Alone it is difficult to go further. You know this and so do investors. Introduce your team or the elements of the team you are looking for, naming the most important roles for the growth of your startup.

8# Sales Volume, NPV, IRR and Payback

To analyze the potential of your investment, the investor needs to have access to these numbers.

The Sales Volume to be displayed corresponds to the value of goods and services sold during a certain period.

NPV is the Net Present Value and measures the effective gain of the investor.

The IRR corresponds to the Internal Rate of Profitability and with it is possible to assess the profitability of the project.

Finally, Payback is the indicator that shows us the payback time

9# Investors and equity percentage

Equity is the ownership and right to the profits that investors will have on your startup once they decide to invest in it and you accept their investment. This ownership in most cases means the shares of the company (and at a later stage it could be shares or other securities).

This is the final part of the investment raising process. Your pitch and business plan successfully brought you this far.

Now you have a very important decision: say yes or no to investors and define the equity percentage. It will be a tougher negotiation phase where you must consider the control you want to have over your startup, the network and experience of the interested investor, and the funding objectives you are looking for.

If you need help moving forward, please contact us.